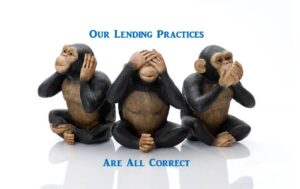

Ask lenders – and just about all will tell you they do their business the right way. If so, they shouldn’t need to worry about any action from the Department of Justice (DOJ) under the False Claims Act (FCA). Right?

Ask lenders – and just about all will tell you they do their business the right way. If so, they shouldn’t need to worry about any action from the Department of Justice (DOJ) under the False Claims Act (FCA). Right?

With everyone supposedly doing business the right way, why does the DOJ keep finding lenders that violate the rules? Could it be that some of the lenders that believe they are okay aren’t aware they have some folks within their organization who are stretching the envelope a little too far? Are they doing this in the interest of increasing business and income?

Maybe it’s done intentionally, maybe not. Regardless, the results are the same. This brings big trouble and big fines for the violating lender and sometimes for their top dog. In the end, it may cost you everything you’ve worked so hard to build.

I am not sure what happened at Allied Home Mortgage of Houston but whatever was happening, it ended up costing them $296 million in fines, plus their CEO, Jim Hodge, was ordered to pay an additional $25.3 million. This was not a settlement, it was a Court decision; jury of your peers.

The jury found that Jim Hodge and Allied defrauded FHA for over ten years and then lied about it repeatedly to try to cover their tracks. You wonder why mortgage lenders get a bad name and restrictive legislation gets passed to control their operations.

DOJ ain’t going away just yet! Seems they are now turning their attention to FHA’s HECM program (Reverse Mortgages).

They recently settled with Financial Freedom (not affiliated with Freedom Mortgage), a sub of One West Bank, for $89 million under an FCA action. This one alleged FF had received unearned interest from FHA in connection with faulty foreclosures.

I guess with the FHA HECM program now part of the mortgage insurance fund, it will now come under much closer scrutiny by HUD and the DOJ.

There’s nothing wrong with this program as long as lenders understand the process and do things according to the requirements and guidelines. That shouldn’t be too much to ask. Is it?

Why do lenders keep violating the rules? You would think after all that’s happened, they would keep a closer watch on their loans and their staff.

Most do comply, through complete and expanded QC reviews to ensure quality and compliance of all loans originated and closed. Do you?

Don’t assume that in your organization everything is being done right and that everybody is playing by the rules. When you do, you expose yourself and your company to serious consequences.

You could deal with consequences not just from FHA and DOJ actions, but from increased and unnecessary, loan defects, that may lead to defaults resulting in indemnifications and loan repurchases. All of this will result in lost revenues.

Better to ensure that you and your staff are all doing things right before CFPB, FHA, DOJ, or some other regulator, tell you otherwise.