Next week, on February 5th, and the four Friday’s following, LoanLogics kicks off a five-part RadioLogics podcast series titled “Friction Free B2B Mortgage Commerce.” Have you subscribed yet? The topic being discussed centers around the immense amount of friction present in our industry’s B2B channels, namely, the correspondent, mortgage servicing rights acquisition and wholesale markets.

This content was first shared in a longer format webinar hosted by National Mortgage News in November. During that event, LoanLogics was joined by panelists from United Wholesale Mortgage, Mr. Cooper and Marlin Mortgage Capital to discuss:

- Sources and causes of friction

- Aligment stratagies between partners

- Available digitial tools and utilities

- Key metrics for success

Hear what this group of experts had to say in short audiio podcast excerpts, released weekly, on Radiologics.

Wholesale and correspondent originations represent more than 50% of all mortgage lending. Mortgage servicing transfers represent billions of dollars and impact nearly 100% of mortage industry volume. All of these are B2B transactions where automation and transparency have been lacking despite the signficant slice of commerce these transactions represent.

The need for improvement was echoed by 70% of attendees polled during the November webinar, who said they were either very dissatisfied or neutral with their degree of satisfaction in their B2B relationships.

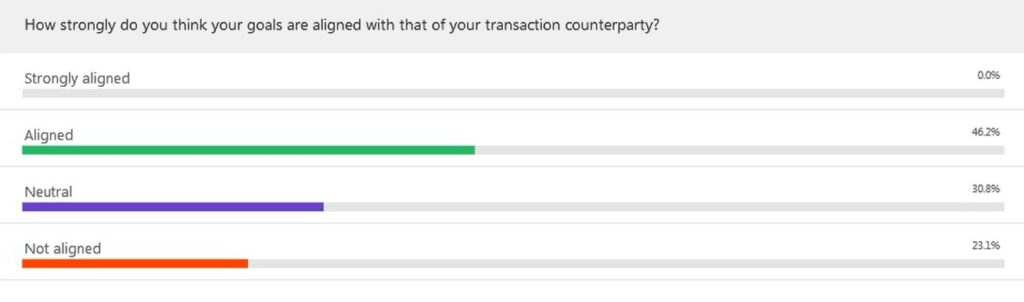

Strength of priority alignment, another topic covered in our upcoming podcast series, was also surveyed. Poll results showed a mixed bag when it came to attendee’s feelings around alignment of goals with their transaction counterparties. Forty-six percent of respondents felt their priorities were aligned, with about 30% neutral and 23% not aligned.

While that figure might lead one to believe there’s no room for improvement, SVP Operations & Co-issue at Mr. Cooper, Bryan Budd translated it well. “If you communicate with your B2B partner, you will find you are very much aligned but from an execution standpoint it may not present itself well. Bryan continued, “So, you need to continue to work on digital and technology solutions to smooth out those transactional relationships and visually demonstrate the alignment.”

That is why the time is now to optimize these high volume, yet dramatically overlooked, transactions. Digital tools and automation are rapidly emerging to faciliate just that. Join us for “Friction Free Fridays in February.” Hear from top leaders who are makings strides in these powerhouse B2B channels, by championing and deploying the tools and stratagies required for change.

Subscribe to Friction Free B2B Mortgage Commerce podcast series here.