It should come as no surprise to anyone in mortgage lending that the industry has been a little late in the adoption of new technologies to help streamline our business.

It should come as no surprise to anyone in mortgage lending that the industry has been a little late in the adoption of new technologies to help streamline our business.

Some of this may be because in the past several years, during the refi boom, business literally came walking through the door. It was all lenders could do to keep up with the volume.

Things are changing!

According to J.D. Power, attendees at the recent MBA National Servicing conference noted new technology as one of their top priorities in 2018. Their report indicates:

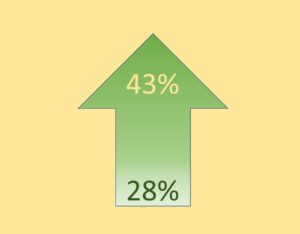

- More mortgage applicants are using online sites for information and application

- Percent of digital apps increased in 2017 to 43% from 28% in 2016

- The choice is based on more than just price. Other factors, like trust, come into play

- The higher the level of satisfaction, the higher the level of trust.

With price not being the main factor, more consumers are shopping for their services online. With an increased demand for self-service applications and immediate response/results, lenders are being forced to implement more technology solutions.

It’s too tough, time-consuming, and expensive, to operate the old way. Lost business hangs in the balance.

According to the J.D. Power study, “the great equalizer in the mortgage business is achieving a balance between convenience, recognition, advice, trust, and value. Building this formula into new technology will be a critical area of focus for the mortgage industry in 2018.” Are you ready?

One drawback to new technology is the cost of the research and development. Legacy Loan Origination Systems are difficult and expensive to upgrade. Creating new systems from scratch could be worse.

If you’re one of the larger lenders this may not be as big of a challenge, but what about the small to mid-size guys? All need the technology to compete, but can you afford the time and investment needed to get it?

There is an option. Many of the applications needed to upgrade your processes are already available. Programs for online applications, electronic verifications, with apps for consumer education and communications.

Other platforms for Correspondent Lending, HMDA reporting, and required QC audits are available either via SaaS or in-house applications.

Such systems provide lenders with the technology needed to compete in today’s digital age without the upfront costs of development, nor the time (and aggravation) it takes to get these operational. These can be plug and play solutions.

So, if you need to get into the game to compete and service today’s demanding tech-savvy consumers, you need to play digitally.

You can invest the time, effort, and money to build the systems you need, or be like the consumers you service, shop around for the best solutions. They do exist and can be implemented rather quickly.

The game has changed. Play different. LoanLogics can help.